5 Lego Case Studies

In order to appreciate the power of investing in Lego, it’s worth taking a dive into some lego sets, to see how they have risen over the past.

Ultimate Collector’s Millennium Falcon

The Millennium Falcon UCS is the poster child of LEGO investing. This colossal Star Wars ship launched in 2007 at around £350 and initially lingered on shelves.

After it retired in 2010, its value rocketed. Within around 3 years it was selling for over £1300. At 5 years post-retirement, they were selling for over £3000, around 10 times the original price!

Café Corner

The Café Corner hotel is a cornerstone (pun intended) of LEGO’s Modular Buildings line and of LEGO investment lore. Released in 2007 at around £88, it retired in late 2009. Few predicted that within a decade it would be a multi-thousand-dollar collectible.

Initially, prices crept up moderately – e.g. by 2012 (around 3 years after retirement) a sealed Café Corner cost about £200. But appreciation snowballed, by around 2013–2014 its value hit £800 and it kept climbing steadily thereafter. Today (mid-2020s) a new Café Corner averages £2,200 (which is over 2100% total growth!) This modestly-priced set turned into a £2k trophy, rewarding investors many times over.

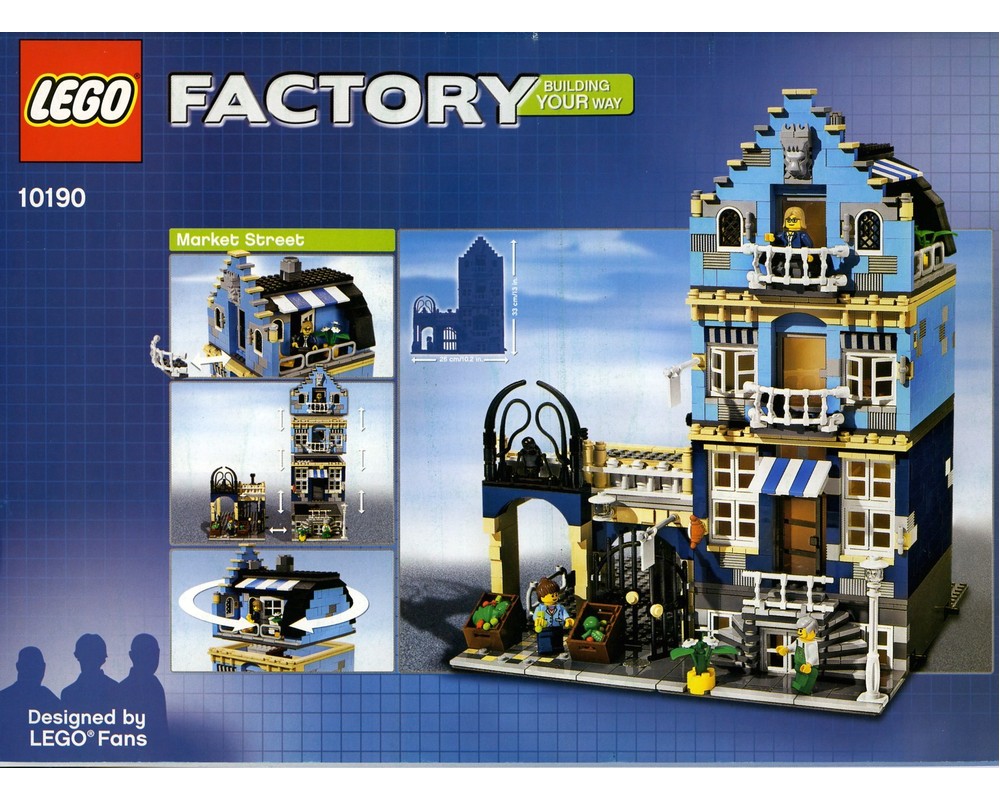

Market Street

If Café Corner was a surprise hit, Market Street was the dark horse that became a legend. This 2007 “Factory” line set (often grouped with Modular Buildings) had a modest £60 price and a relatively limited production run. It quietly retired by 2008, initially flying under the radar, but its aftermarket story is astounding. With far fewer copies made, prices exploded almost immediately after retirement.

Within a few years Market Street was already worth several hundred pounds. By the mid 2010s it crossed the four-figure mark. Today a sealed Market Street is valued around £2,450, an eye-popping +3567% increase from retail, making it one of the best LEGO ROI examples ever. In other words, a £60 investment in 2007 could be sold for over 35 times that amount now.

Statue of Liberty

The Statue of Liberty sculpture from 2000 is an early example of LEGO’s big adult sets – and a case of dramatic long-term growth. Retailing for about £130 back in 2000, this 2,882-piece set quietly appreciated over decades as it became a coveted display piece. By 2010, it was already selling for several times its MSRP (e.g. around £900 by 2013, a +573% gain at that point).

The upward trend continued albeit more slowly in later years. Today, a sealed Statue of Liberty goes for around £2,100, roughly 15× the original price. Interestingly, by the mid-2010s some thought it might have hit a ceiling – it even dipped ~13% in value around 2012, possibly as prices got ahead of themselves, but it later resumed climbing to its current level.

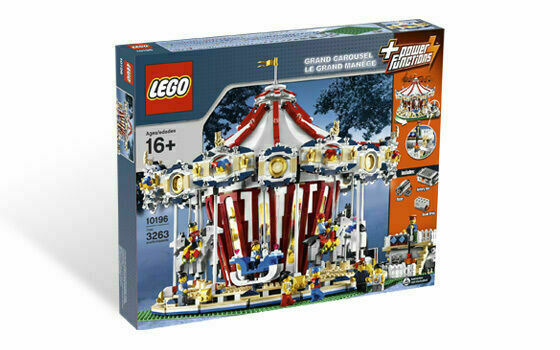

Grand Carousel

The Grand Carousel (2009) is a large, motorized fairground set that has become very valuable over time. Its launch price was around £180. It retired fairly quickly in 2010 and soon became sought-after, as LEGO rarely makes such elaborate motorized carousels. Investors who grabbed these early saw substantial profits.

By the mid-2010s, sealed Grand Carousels were selling for around £700. Today, the Grand Carousel is worth roughly $2,600, about +949% above MSRP (~10.5× its original price). That’s nearly a tenfold return in ~15 years.